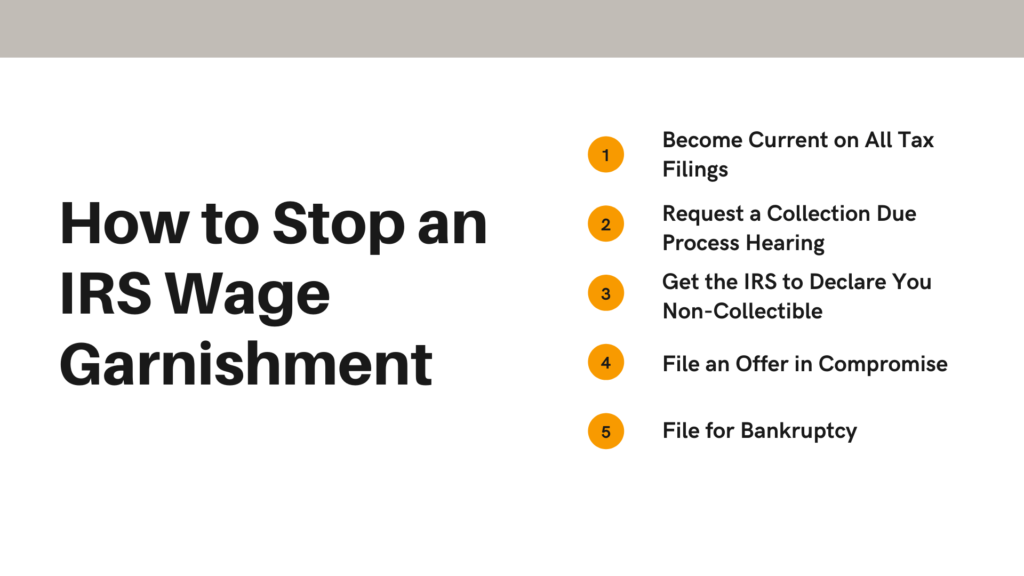

How to Stop an IRS Wage Garnishment: 5 Options

When you have tax debt, it’s possible that the IRS can garnish part of your income in what is referred to as a “continuous levy.” If you fail to reply to their request for repayment, the IRS will notify your employer, and a large portion of your income will automatically be charged toward your tax debt balance. They can take a quarter or more of your monthly income, which can imply hefty financial strain. The good news is, there are several choices for just how to quit IRS wage garnishment. Decide which alternative is best for you so you can stop IRS wage garnishment as well as reduce the worry associated with the financial burden.

The best resolution is determined mostly based on the total amount of tax debt being attributed to you, as well as your compliance and financial situation. Here are some steps you can take to stop wage garnishment and get back on the better side of the IRS’s favor.

1. Become Current on All Tax Filings

In other words, you need to file all your tax returns required before the IRS can consider working with you on a tax resolution. Although this does not help with mitigating your tax, you will be in a better position in terms of compliance, which is your foot in the door to other types of negotiations with the IRs.

2. Request a Collection Due Process Hearing

A Collection Due Process (CDP) hearing is a process the IRS Office of Appeals conducts, which is an independent organization within the IRS, separate from the Collection Office.

If the IRS sends you a final notice of their intent to put a levy on your wages, request a CDP hearing within 30 days from the date of the notice, and the wage garnishment will usually stop.

Here are the steps:

- Fill out Form 12153 (https://www.irs.gov/pub/irs-pdf/f12153.pdf)

- Make sure to offer a defense or claim hardship. THIS IS IMPORTANT!

- Make a copy of your filled out document.

- Send it to the return address posted on the envelope of the notice of repayment you received.

3. Get the IRS to Declare You Non-Collectible

One of the most obvious next steps is proving financial hardship, which will force the IRS to declare you as non-collectible. You, basically, show that the strain of the levy would prevent you from providing basic financial support for yourself and your family. This is a very detailed undertaking, so find help – hint, hint, nudge nudge – to have the best shot possible.

4. File an Offer in Compromise

An offer in compromise is an alternative payment method the IRS can accept, once approved, to stop an IRS wage garnishment. Keep in mind that you must be in a good position with the IRS in terms of compliance, so make sure to file all the tax filings you need to become current.

5. File for Bankruptcy

As a last resort, there is the option of filing for bankruptcy. There are pros and cons to this method, but the main thing to keep in mind is that, when all is said and done, you could still owe the IRS tax debt and go right back into wage garnishment actions. Before you do something so drastic, it is smart to work with a tax professional to find out if your tax debt will be erased to the degree that wage garnishment would be out of the question on the IRS’s part.

What Follows is NOT How to Stop an IRS Wage Garnishment

This section of the blog is to alert people to some really, really bad advice floating out there on the internet. This is NOT how to stop an IRS wage garnishment.

1. Work Less in Order to be Declared Non-Collectible

This basically means working fewer hours to fabricate the illusion that you are facing financial hardship. Keep in mind that the IRS doesn’t have to work through your employer to collect tax debt; it can take control of your bank account – especially if you are believed to be doing this as a maneuver to avoid paying your tax debt. No, it’s always better to be forthright with the IRS.

2. DO NOT Quit your Job

Just like working fewer hours, quitting your job can be fishy, and it can lead to the IRS taking control of your bank account. This is an option we DO NOT recommend, and shame on the blogs out there that advocate this.

Conclusion:

Here’s the punchline: work with My Tax Settlement to find the best path forward. We will make sure you understand the consequences of your decision and allow you to weigh them against each other. We are not here to decide what to do; we are here to inform you so you can make the best decision.